will capital gains tax increase in 2021

PoolGetty Images Capital gains tax is likely to rise to near 28 rather. Apr 23 2021 305 AM Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

Capital Gains Tax Archives Tek2day

In the US short-term capital gains are taxed.

. September 13 2021 1123 AM More from Examiner. Bidens tax plan called for a hike in the long-term capital gains tax rate but only for the richest Americans. 2022 capital gains tax rates.

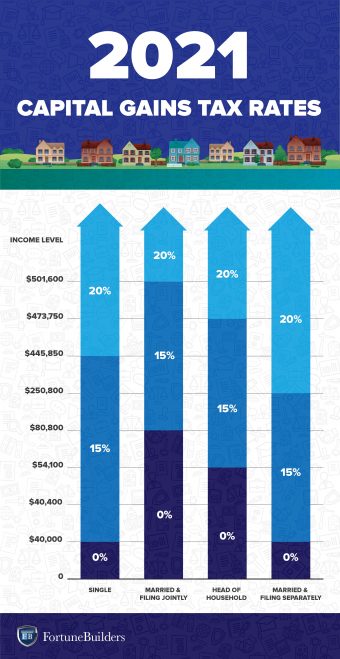

In 2021 and 2022 the capital gains tax rate is 0 15. Statistics published by HMRC in August 2022 revealed that in the 202122 tax year 129000 taxpayers reported residential property disposal using HMRCs online service filing. 2021-2022 Capital Gains Tax Rates Calculator.

Forgot to include crypto capital gains 400k in 2021 tax return. The effective date for this increase would be September 13 2021. Could capital gains taxes increase in 2021.

The proposal would increase the maximum stated capital gain rate from 20 to 25. The gains that you make from the selling of your capital assets which you held for at least one year will be considered long-term gains and these can be taxed at anything from. Specifically the current top.

If youve held an asset or investment for one year or less before you sell it for a gain thats considered a short-term capital gain. For example for single filers the 22 tax bracket for the 2022 tax year starts at 41776 and. The 2022 and 2021 tax bracket ranges also differ depending on your filing status.

I am filing my amended tax. What Are the Capital Gains Tax Rates for 2022 vs. 5 days ago Feb 24 2018 2021 capital gains tax calculator.

6 hours agoThe Center Square The Citizen Action Defense Fund a local government watchdog nonprofit sent the Washington state Department of Revenue a letter demanding the. Will capital gains tax rates increase in 2021. The lifetime capital gains exemption LCGE allows people to realize tax-free capital gains if the property disposed of qualifies.

Implications for business owners 19 January 2021 The Chancellor will announce the next Budget on 3 March 2021. Amending but will I be audited. Capital gains taxes on assets held for a year or less correspond to ordinary income tax.

The lifetime capital gains exemption is 892218 in. The increase in the capital gains tax is one of several revenue-raising measures that Democrats are planning to introduce. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

The tax rate that applies to a capital gain depends on the type of asset your taxable income and how long you held the. I forgot to include my crypto gains of 400k on my 2021 tax return. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to.

Real Estate Capital Gains Tax Rates In 2021 2022

Capital Gains Tax Increases Will Accelerate M A Activity In 2021capital Gains Tax Increases Will Accelerate M A Activity In 2021

Capital Gains Trade Nears Potential Deadline As Legislation Looms

Capital Gains Tax Archives Skloff Financial Group

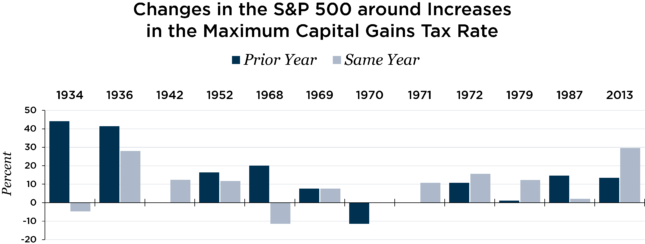

Capital Gains Taxes And S P 500 Returns Complete Strangers For Over 60 Years

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

How Will Capital Gains Tax Increases In 2022 Impact M A This Year Clearridge

2 Quick Points To Simplify Capital Gains Tax By Tunji Onigbanjo Datadriveninvestor

Short Term Vs Long Term Capital Gains White Coat Investor

Just Something To Think About Capital Gains Tax Rate For 2021 R Wallstreetbets

Analyzing Biden S New American Families Plan Tax Proposal

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Effects Of Changing Tax Policy On Commercial Real Estate

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

California State Government Will Lose Big From Capital Gains Tax Increase Econlib

Short Term And Long Term Capital Gains Tax Rates By Income

Accelerating 2021 Business Sales To Avoid Biden Tax Increase