child tax credit 2021 dates canada

Normally anyone who receives a payment this month will also receive a payment each month for the rest of 2021 unless they. Up to 3600 per qualifying dependent child under 6 on Dec.

Psa Didn T Get A Stimulus Payment You Might Need To Do This In 2021 Child Tax Credit Tax Debt Irs

Do not use the Child Tax Credit Update Portal for tax filing information.

. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain income limits see the FAQs below. If a family is entitled to receive the CCB in October 2021 for a child under the age of six they can expect to receive. 15 opt out by Aug.

The cra makes canada child benefit ccb payments on the following dates. The following amounts are for the payment period from July 2021 to June 2022 and are based on your AFNI from 2020. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Important changes to the child tax credit will help many families get advance payments of the child tax credit starting in the summer. The irs bases your childs eligibility on their age on dec. For 2021 the maximum child tax credit is 3600 per child age five or younger and 3000 per child between the ages of six and 17.

For the 2021 tax year the child tax credit offers. 13 rows The government has a child and family benefits calculator you can use to estimate your monthly CCB. To reconcile advance payments on your 2021 return.

Here are the child tax benefit pay dates for 2022. October 5 2022 Havent received your payment. Wait 10 working days from the payment date to contact us.

300 per child if the net family income for 2020 is 120000 or less. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Child tax credit family element.

Maximum Canada child benefit. It will not be reduced. 5765 per year 48041 per month for each eligible child aged 6 to 17.

15 opt out by Nov. 13 opt out by Aug. The 2021 tax deadline is fast approaching--save the date its on April 18 this year.

The payment dates for ccb young child supplements for 2021 are. Canada workers benefit CWB - advance payments All payment dates. Creating more benefits to supplement CCB.

This tool can be used to review your records for advance payments of the 2021 Child Tax Credit. The CTC income limits are the same as last year but there is no longer a minimum income so anyone whos otherwise eligible can claim the child tax credit. Child Tax Credit Update Portal.

150 per child if the net family income for 2020 is more than 120000. Wait 10 working days from the payment date to contact us. You will not receive a monthly payment if your total benefit amount for the year is less than 240.

Enter your information on Schedule 8812 Form 1040. The irs will pay half the total credit amount in advance monthly payments beginning july 15. Canada Child Benefit CCB Payment Dates 2022.

These amounts start being reduced when. Child tax credit 2021 payment dates. Between July 2021 and June 2022 your child under six years old can get you up to 6833 in CCB if your average family net income falls below 32028.

15 opt out by Oct. But for parents who got an advance on the child tax. Its usually around the 20th of the month but some dates are different for example December its a little earlier because of the holidays.

15 opt out by Nov. Up to 3000 per qualifying dependent child 17 or younger on Dec. Canada Child Benefit CCB Payment Dates 2021.

15 opt out by nov. 6833 per year 56941 per month for each eligible child under the age of 6. Eligibility for the gsthst sales tax credit how it is affected by marital status and information about payments.

Child tax credit payment dates are changing this month updated. Canada child benefit dates 2021. By August 2 for the August payment August 30 for the September payment.

Instead you will receive one. List of benefit payment dates including the canada child benefit and gsthst credit and provincial payment dates. Alberta child and family benefit ACFB All payment dates.

Under 6 years of age. May 28 2021 includes january and april payments july 30 2021. We calculate the CCB as follows.

If your adjusted family net income AFNI is under 32028 you get the maximum payment for each child. To complete your 2021 tax return use the information in your online account. You can also refer to Letter 6419.

In previous years 17-year-olds werent covered by the CTC. Child Tax Benefit Payment Dates 2022. Get your advance payments total and number of qualifying children in your online account.

To get money to families sooner the IRS is sending families half of their 2021 Child Tax Credit as monthly payments of 300 per child under age 6 and 250 per child between the ages of. 6833 per year 56941 per month. 13 opt out by aug.

The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. 29 What happens with the child tax credit payments after December.

Joe biden expanded the child tax credit scheme from 2000 to 3600 earlier this year.

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

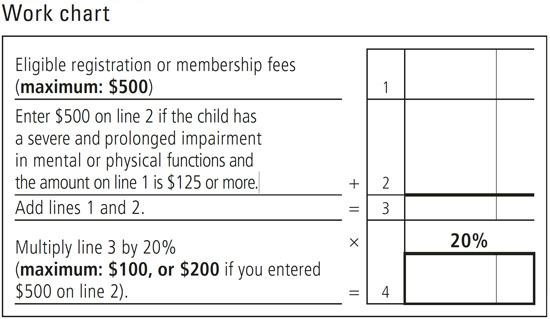

25 Tax Credit For Children S Activities Line 462 Revenu Quebec

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Canada Child Benefit Ccb Payment Dates Application 2022

Canadian Disability Tax Credit 2021 Turbotax Canada Tips Tax Credits Turbotax Tax Prep

Claiming Expenses On Rental Properties Tax Time Rental Income Tax Deductions

Pin By Graciela Lopez On Lugares Que Visitar Woodworking Projects Diy Woodworking Projects Diy Projects

Canada Child Benefit Ccb Payment Dates Application 2022

Canada Child Benefit Ccb Payment Dates Application 2022

Summer Jobs And Taxes Part 1 School Aged Children Under 18 2021 Turbotax Canada Tips In 2021 Turbotax Financial Education Tax Refund

Always Keep Employee Td1 S Up To Date Tax Credits Hiring Employees New Bus

Canada Child Benefit Ccb After Separation No Cra Audit

Canada Child Benefit Ccb Payment Dates 2022 Loans Canada

Taxtips Ca 2021 Non Refundable Personal Tax Credits Base Amounts

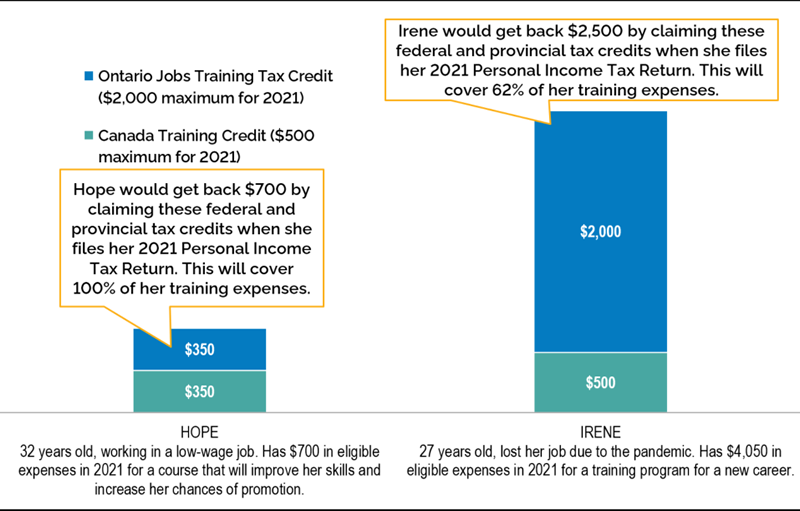

Ontario Jobs Training Tax Credit Ontario Ca

How To Get Rich In Canada Be Glorious And Free Genymoney Ca How To Get Rich Money Management Investing Money